I'm going to greatly expand on this topic, so I'll keep this post as short as possible. I could write a book on this post alone. For now, I want to quickly get down my thoughts on the five most critical ingredients to build a big company - one that changes the world and creates a lot of jobs and economic impact. Here are the ingredients:

A quick (restaurant) review of Sway

Last night I ate at Sway - the new restaurant from Delfo Trombetta, the entrepreneur behind La Condesa. Delfo asked me to invest in Sway, and I passed. I'm regretting that decision now (just like I regret passing on investing in Uchiko and Uchi Houston when Tyson Cole asked me). Restaurants are tough investments, but when they hit - they can really hit big. La Condesa is a favorite in Austin - located conveniently downtown just a block from the W Hotel. La Condesa has amazing and progressive Interior Mexican food. Sway, on the other hand, has amazing and progressive Thai food. It was quite a treat, and I highly recommend it. It has only been open a few weeks, and it was already the second time my Bazaarvoice co-founder, Brant, had been! Brant is a foodie - I turn to him first for new restaurants to try.

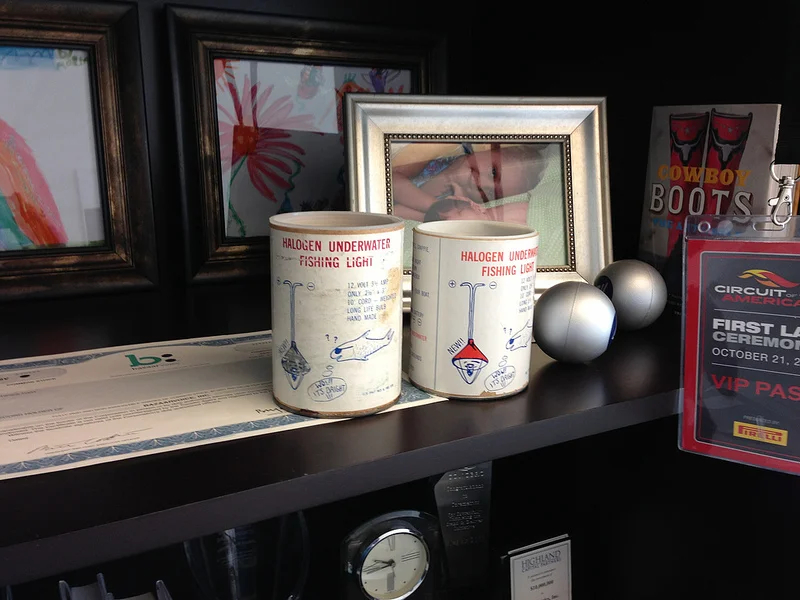

What I learned from my dad's first commercial invention

I remember working on the label design with my father. There were no printers back then - this was in the early 1980s. This label was handdrawn by my dad. I remember his joy in selling and shipping these all over the world. I remember his many conversations with fellow fishermen about it, and retailers. I remember his anger when competitors infringed on his patent. I saw the ups and downs (mostly ups, fortunately). He was Tim Ferriss - but the real deal. Tim Ferriss isn't even "Tim Terriss" (I'm sure that the real Tim Ferriss is one of busiest people in the world, traveling and speaking all of the time). My dad wanted the lifestyle that would afford him the time to spend with us and go fishing 2-3 days each week. He achieved that. He lived his whole life like he was "on vacation". He pursued his passion from the beginning. I did the same with Bazaarvoice and Coremetrics. And, of course, I'm still very involved with and love Bazaarvoice. And I'll never forget the incredible experience at Coremetrics either (I'm not involved there today but still have a love for it; IBM acquired it two and a half years ago).

To be stealthy or not?

What's in a name?

Yesterday's post on why I named my blog Lucky7 in honor of my mom and my resulting Twitter batter on our company's name with Sam Decker reminded me of a few stories about how I came up with the name Bazaarvoice.

I remember the day I came up with the name Bazaarvoice like it was yesterday. Rachel was just six months old and we were in Cabo San Lucas in April 2005 using our last few weeks of vacation at Coremetrics before I left to take the plunge to start Bazaarvoice with Brant Barton. I was reading Chapter 4 of The Cluetrain Manifestoand it hit me - big time. That chapter moved me more than almost anything I had ever read. The "voice of the marketplace" - it was perfect. Like the name Coremetrics, it described exactly what the company did. It was a bit of an irreverant name, likely to be confused with Bizarrevoice but that was actually a good thing in this case. There was meaning in that - the voice of customers would indeed sound "bizarre" to all of the corporate types that had been locked away in their towers instead of walking their store aisles like Sam Walton, the founder of Wal-Mart, used to do to "keep it real" and then taught his children in his book Made In America.

Why Lucky7

My mom passed away on May 17 of this year, the same week that we had the celebration dinner for our IPO at Bazaarvoice and the sales team celebration dinner for those that beat quota in Q4. It was very hard, especially after losing my father just four years prior. I encourage you to read about his life in the tribute I wrote about him. He was an incredible entrepreneur. But it was my mom that lit the initial spark in me. And that is why I named my blog in her honor. If you read my tribute about her below, you'll know why I named this blog Lucky7. As far as the .io name, well that of course stands for input and output, which I'm all about and also reminds me of my roots as a young programmer. My mantra at Bazaarvoice as our CEO was b: authentic.

My first blog post (Feb. 3, 2006)

Looking back the beginning of Bazaarvoice, I remember my first blog post like it was yesterday. I remember how odd it was to blog back then. Sam Decker had joined me, Brant, Paul Rogers, Jacob Salamon, Jason Amacker, and a few others as our founding CMO. He had joined us from Dell where he was the first blogger in their company's history, I believe, and had his own blog site at DeckerMarketing (which is still live today and Sam is now a successful CEO at Mass Relevance). Sam wasted no time convincing me and Brant that we must blog for our company launch out of "stealth mode".

Mary Meeker's Internet Trends

I consider Mary Meeker's Internet Trends a must-follow report everytime she puts out an update. How smart it was for KPCB to hire her. She is world-class at research, and every technology entrepreneur and executive would be wise to religiously follow her reports.

Before she left Morgan Stanley for KPCB, I had the pleasure of having dinner with her and Morgan Stanley's CEO, James Gorman, a little over a year before our IPO at Bazaarvoice. It was an evening to remember - a live MBA case study, with James giving the insider's report of the financial crisis. Mary's perspective was fascinating too, not surprisingly.

Here is her latest update, presented on Dec. 3 at Stanford. There is too much to comment on here, and I recommend you study every slide. There are a thousand good business ideas in here for aspiring entrepreneurs that want to change the world.

Capital for your business = fuel for job growth

This is a cool study from Pepperdine on job growth for private-capital-backed companies vs. those that do not receive funding. Jobs and revenue grow much faster. I believe this is primarily due to a selection bias in the entrepreneur. Like I discussed in my post on Bootstrap or VC? before I started Bazaarvoice, the hat trick for entrepreneurs is to be capital efficient but also not starve their business of growth because they are trying to protect themselves from being diluted as a primary driver versus building their business for the benefit of all. In other words, the type of entrepreneur - and their ambition - makes a huge difference in the ultimate revenue and job growth that their business will experience. VCs obviously look for entrepreneurs that want to hit a home-run and in this way everyone's interests are aligned - as long as the entrepreneur can stomach some dilution for the greater good.

The results were even more dramatic for the 1,854 recipients of venture capital. During the five years after their financing event, these establishments:

- Generated an increase in revenue that was $24.7 million higher (846 percent more) than non-backed counterparts. This translated into a 36.4 percent compound annual growth rate versus a 6.9 percent rate for non-funded establishments.

- Created 127 more new jobs (608 percent higher) than non-backed establishments —a 22.4 percent compound annual growth rate versus a 4.5 percent rate for the control group.

Here is the full study.

Capital efficiency on the way to IPO

It makes sense to me that many IPO candidates are B2B companies. The picks-and-shovels companies versus the gold-miners. But what stood out to me in this article is this nugget:

"While its true that it has become easier to start a company on very little money, the average amount raised by companies in CB Insights' report is $84.7 million."

As I pointed out in my "Bootstrap or VC?" post, we raised around $24 million and had around $12 million left in the bank when we went public. You can build a better culture if you are capital efficient, and also have a bigger economic ripple effect. I'll write more on that some other time, but for now I'm proud we were able to scale 75% more efficiently, on average, on our own path to IPO.