For all of us Austin fans, I'm talking about Cotter Cunningham, the founder and CEO of RetailMeNot. Last night, Cotter was one of our keynote speakers, along with Mark Cuban, at the University of Texas for Longhorn Startup Demo Day (the event was just fantastic, by the way, and Josh Baer, Ben Dyer, and Bob Metcalfe deserve a huge round of applause for it).

As of today, RetailMeNot is worth $1.33 billion as a public company (it went public in July and just filed for a follow-on offering). It is just four years old - for a value creation of $333 million per year. Who says Austin can't do B2C now? HomeAway is another one of our five tech IPOs in the last five years. It is worth $3.4 billion today as a public company (it went public in 2011). It is just nine years old. Yes, we haven't produced a Facebook or Twitter size outcome - there needs to be a higher volume of failures (entrepreneurial experiements) to do that, but don't forget we did produce a Dell, a National Instruments, and a Whole Foods.

As Cotter explained at Longhorn Startup, as well as when I interviewed him as part of my Entrepreneur-in-Residence Speaker Series at the McCombs School of BusinessHerb Kelleher Center for Entrepreneurship, his entrepreneurial journey at age 46 started out with the euphoria of being his own CEO followed by a gut-wrenching pivot. Cotter bucks the flavor-of-the-day entrepreneurial stereotype: the college dropout popularized by both our own Michael Dell and recently Mark Zuckerberg and the great movie The Social Network. Michael and Mark are business savants, just like Michelangelo was an art and engineering savant (by the way, I'm pretty sure Michelangelo would have made a damn good entrepreneur in this day and age). Most of us simply aren't savants. I don't consider myself one - I didn't start my first business until I was 24 and earning my MBA and I didn't hit on something big enough to drop out of my MBA so I proudly finished and then chose Coremetrics. Cotter's first company was called Divorce360.com and you can see him quoted as their CEO here. After more than a year, it was a miserable failure. And the funny (and fortunate) thing is - Cotter has never been divorced! Instead of crying in their beers about it, Cotter and Tom Ball at Austin Ventures decided what to do next and came up with Small Ponds, which later became Whale Shark Media and then RetailMeNot (named after it's largest digital property). No matter the name - the business was the same and through acquisitions it became to be worth $1.33 billion as the juggernaut it is today. Here it is in Cotter's own words:

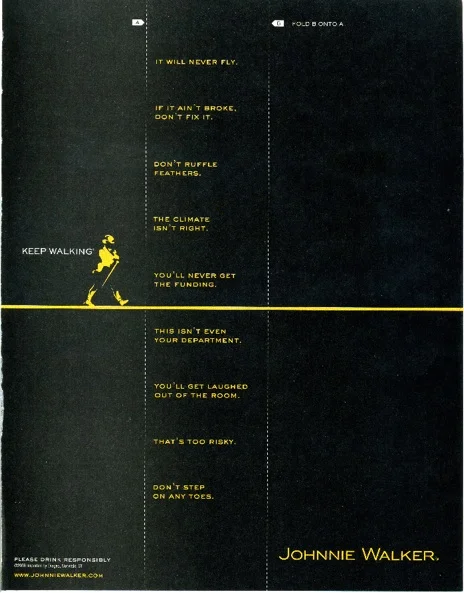

The line between success and failure is sometimes very thin indeed, and that is the subject of this blog post. To be very upfront, my goal is to help Austin entrepreneurs shrug off failure more easily - after accounting for the important lessons learned - and just "keep walking".

We all know the famous story of Apple, which at one point kicked out it's co-founder and CEO, Steve Jobs. After his walk in his wilderness, both literally and figuratively, he returned with a vengenance. Today Apple is worth $510.96 billion, or $100 billion more than Exxon Mobil, making it the most valuable company in the world. What if Steve Jobs had not shrugged off failure and gotten his mojo back?

Apple's had several near-death experiences. As author, investor and now Google advisor Guy Kawasaki puts it, the company must have a guardian angel. And in the mid-1980s, that guardian angel was Aldus PageMaker. (source: First Round Review's Kawasaki on Why Your Startup is Dead if You Can’t Enchant

Do you know the story of OneSpot? It started in 2007 here in Austin and was founded by my friend Matt Cohen. It had a gut-wrenching pivot as the first business model didn't work and today is thriving with its new one. Matt and his new CEO, Steve Sachs, just raised $5.3 million from principally Mohr Davidow Ventures (Hurt Family Investments also participated), and Bryan Stolle joined their Board of Directors. Bryan is an amazing entrepreneur and is very focused on investing in Austin startups, even though he is based on the West Coast. Bryan and I were together on Tuesday talking about how Matt deserves the entrepreneurial persistence award and how thin the line is between success and failure. Bryan related it to sports - he said if you carefully watch one of the big games there are usually just 3-4 plays that make - or break - the game. Alabama knows this all too well after the Auburn game.

Have you met Mike Maples, Jr.? He was previously of Austin entrepreneurial fame as the founder of Motive, which went public, and is a very active West Coast VC today (who, like Bryan Stolle, also invests in Austin startups, including Bazaarvoice, Outbox, Mass Relevance, and many others). He talks about the brutal, gut-wrenching nature of the pivot that OneSpot successfully completed in this video (source: TechCrunch's "You Have to Be Willing to Throw it all away"). This is one of the most important training videos for entrepreneurs, in my opinion, and well worth the watch. Mike's most famous seed investment is Twitter. Much like Cotter's Divorce360.com, Twitter started out as a failure - with Odeo. Odeo needed to pivot, it simply wasn't working. Mike helped Ev Williams and Jack Dorsey capitalize Twitter, and the rest is history. Twitter is worth $24.85 billion today, after only seven years in business. Ev and Jack are worth billions now based on the value of their Twitter holdings alone, and both are off and running other successful businesses (everyone knows the success of Jack's Square). What if Ev and Jack hadn't pivoted?

One of my friends is going through a "failure" right now. The market for the product simply wasn't a good one. It is an emotional time for him, but you simply can't knowthis until you try. At the beginning of Coremetrics in 1999, the market risk was whether or not companies would embrace the outsourced model (what we called ASP, or Application Service Providers, back then, and are now called SaaS, or Software as a Service, or "cloud" providers). At the beginning of Bazaarvoice in 2005, when there were only around three retailers in the US that offered customer reviews on their websites, the market risk was whether or not we could convince retailers to embrace both the positive - and negative - voice of their customers and talk them off the ledge that negative reviews wouldn't tank their overall sales. These may sound like easy challenges as you are reading this but I can assure you they were not. And both companies would have turned out very differently had the market not been "ready enough" to allow us to convince them. The bottom line is that when Debra and I make seed investments at Hurt Family Investments, we realize that the market risk is very high. There is nothing like execution to find out. Even the best laid plans don't matter if the market doesn't buy it…

And at Coremetrics, it turned out we were too early. Our original investors made very little - unless they kept investing through the pivot. Our pivot wasn't a business model pivot - it was a target market pivot. We started out in 1999 selling to dot-coms. We were very successful at it and grew to 100 people strong in just one year. Then they almost all went out of business. We pivoted to sell to traditional retailers, which had only begun to sell online, after letting go of 2/3rd of our people, many who I considered close friends. It was one of the most gut-wrenching experiences of my life. Wal-Mart was an early win after that pivot, and then we took off. If it wasn't for a fierce conversation that I had with Arthur Patterson, the co-founder of Accel Partners, Coremetrics would have gone out of business in early 2001. Arthur stepped up and made a big statement by leading a huge round of funding in our company at that time (archive). This near-failure story is well documented by the Austin American-Statesman in this interview. I know all too well how thin the line can be between success and failure.

Remember: most people read the news and the rare few make the news. Those who make the news set the tone for the rest. Sometimes it is very, very hard to make the news, and the line between success and failure is sometimes very thin.

Keep walking, Austin… no one said it would be easy to be an entrepreneur, but the journey is the reward… reflect on and learn from your mistakes but don't marinate in them, just keep walking…

What are your "failure" stories? Let's get a dialogue about this going in the comments below - perhaps we'll be able to help someone on their journey.