This is part two of a three-part series on entrepreneurship. The parts:

- 'Is it too late for me to start my own business?', and other sheepish questions (Lucky7 post)

- Who this new generation of aspiring entrepreneurs are and the new Golden Age of tech

- How I define the soul of entrepreneurs: you change the world (Lucky7 post)

Part Two

We live in very interesting times. It's 2010 and I'm at a family reunion. We've just barely survived the most cataclysmic global financial crisis in the modern history and one of my cousins asks me, "How can tech be doing so well while the rest of the economy is doing so poorly?". I did my best to answer but the question kept eating at me. I remembered Michael Porter's Harvard Business Review article about the Internet being the sixth force - and how it would disrupt all of the previous five forces cited in his famous strategic model.

Fast forward just four years later and a five-year old company, WhatsApp, is bought for $19 billion by Facebook, a company that itself is only ten-years old at the time but worth a mighty $170 billion. Just two years earlier, when Facebook went public, the media was asking for Morgan Stanley's head - and sometimes Mark Zuckerberg's or David Ebersman's (CFO of Facebook) head - for what was perceived at that time as an overpriced IPO. Except that it wasn't... and any investors that held on to their IPO stock should now be very happy campers.

When five and ten-year old companies are valued at $19 billion and $170 billion, respectively, sometimes I hear the "bubble" word. This is a word that has very personal meaning to me. I lived through the ultimate "bubble" popping when I lived in San Francisco from 2000-2003. I remember going to Starbucks and the barista lamenting that they used to be one of the heads of marketing at Pets.com (remember the sock puppet?). I remember how one person I knew, Tony Perkins (the founder of the VC blogging network AlwaysOn), called the ball in his book The Internet Bubblein November of 1999. Almost no one believed him at the time, and then - WHAM - it happened. It was very painful. I had to let 70% of our people go at Coremetrics while our dot-com client base very rapidly dwindled from 100 clients to 2. We survived... barely... to fortunately thrive later.

But today I believe we are in the opposite of a bubble - I believe are in the new Golden Age of tech. While it always makes one nervous to make a forecast like this, I think the years ahead will be some of the best ever for tech entrepreneurs. And I've been putting our money where our mouth is on this with Hurt Family Investments andour growing portfolio.

To understand why, first you have to understand what is happening with exponential, digital, and combinatorial technologies. The book review I wrote on The Second Machine Age explains this - and the book itself is a must-read on this topic. We live in an unprecedented time and everything is speeding up - and not just with Internet technologies. When I was a kid I would tell my elementary school teachers that computers would transform all industries. That as they speed up, all industries would change more quickly. I was too young to use words like "disruption" but that is exactly what would happen - at an accelerating pace. Whether it is the "Internet of things", smart-phone and tablet adoption, the social revolution, 3D printing (including food and organs), personalized medicine, nanotechnology, artificial intelligence and machine learning, or any number of fields computers are rapidly changing, it is happening... everywhere.

Today, most people - anywhere in the world and with purchasing power - are online... and online is portable. We all have a supercomputer in our pockets (and a rare few of us wear them on their faces - me not being one of those). Your ability to reach the world market has never been greater or more efficient. The price and speed at which you can launch a new business because of cloud services like Amazon's Web Services or Google's Cloud Platform has never been lower or faster, respectively. The price to experiment - and potentially create something valuable that the world needs now - has never been lower (both in terms of time and money).

There is more access and knowhow on how to launch a business now than ever before. Accelerators and incubators are thriving and launching all over the world (I just heard of another one launching in Austin soon). Some VCs are seeing record returns (Facebook's IPO alone made Accel Partners a very rich return and Twitter's IPO was a huge boon to Mike Maples, Jr.'s Floodgate - and Uber's recent $18.2 billion valuation and presumably upcoming IPO will do the same for First Round Capital). Business schools are much further along in teaching entrepreneurship than they were when I attended Wharton from 1997-1999. Case studies are more developed. Entrepreneurs come back more often to explain to students how they did it - sometimes in the form of Entrepreneur-in-Residence (I served in this capacity at U.T. Austin for the last academic year and I go back to Wharton every year to do this as well). Entrepreneurship is at record levels in terms of graduating student interest. Entrepreneurial books are more sophisticated than they've ever been - at least to the extent I'm talking about books on how to identify and rapidly capitalize on an opportunity in this new Golden Age. There are entrepreneurial blogs everywhere - available for free for anyone with the ambition to read them (one of my favorites isFirst Round Capital's Review). The global financial crisis of just a few years back has shaken up everyone's confidence in "the system" (even to the point where people would put blind trust in a "Bitcoin"). Unemployment globally remains at very high levels - creating more entrepreneurs out of necessity than ever before, and during this time of unprecedented access due to all of the ingredients I mentioned above.

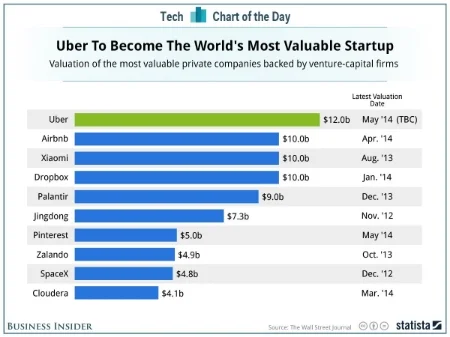

Valuations are also more entrepreneur friendly than ever before. I believe this is not only due to VC "greed" or some other shallow reason but rather because of the ingredients I mentioned above. It is because the Internet and computers (mobile included) have made capitalism more efficient. We had fun with our Lucky7 discussionof Snapchat's $3 billion valuation just a few months before WhatsApp received their $19 billion offer from Facebook. In May, Business Insider posted this chart of the day when Uber was rumored to be getting valued at $12 billion. Of course, the actual number turned out to be a whopping $18.2 billion just a few weeks later.

One interesting aspect of this chart to me, as an Austin native, is that seven out of these top-ten privately valued companies were founded in Silicon Valley. The other three (Jingdong, Xiaomi, and Zalando) weren't founded in the US. As I wrote about in my state of tech entrepreneurship in Austin post, this isn't because something is "wrong" with Austin. A little over a year after I wrote that post, Austin has progressed even more - with RetailMeNot and Q2's IPOs (valued at $1.3 billion and $467 million, respectively), Mohr Davidow's investment alongside us in OneSpot, President Obama's visit to Capital Factory (Lucky7 post), TechStars Austin launching (Lucky7 post), LiveOak Venture Partners closing their first fund and Silverton Partners closing their fourth fund, Capital Factory being named a Google Tech Hub, Google Fiber announcing they'll launch here, Capital Factory companies receiving matching funds from Silverton and Floodgate, MapMyFitness and BlackLocus being acquired by Under Armour and The Home Depot, respectively, and both resulting innovation centers established here, and countless other amazing and unprecedented things happening in this great city.

So what is the reason? It is simply a law of numbers thing. It takes a tremendous number of experiments to produce top-ten global valuation outcomes and Silicon Valley has more of everything in entrepreneurial tech - than any other place in the world. Remember: you can still produce huge outcomes even if they aren't top ten globally, and this certainly has been true for Austin in the past six years (six tech IPOs in the past six years and many more in large acquisitions, especially with Indeed -blog post). To understand this more, I suggest you read about VC returns and the power-law distribution characteristics of them in this blog post by Tren Griffin on lessons learned from Marc Andreessen (I've seen Mike Maples, Jr. write about the same too).

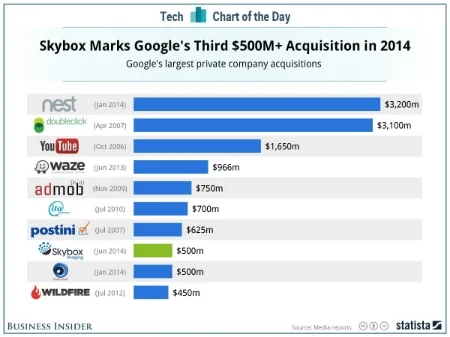

And on entrepreneur-friendly valuations, don't forget about M&A. Google recently made their third $500m+ valuation of this year as you can see in the chart below. Again, valuations are more efficient - and rapidly rising as value is more quickly realized (both current reality for the business and it's future potential) - in this new Golden Age of tech. [Note: I remember how much Google was ridiculed for paying $1.65 billion for YouTube in 2006. But Nest for $3.2 billion? Hardly a word about it.]

So if this is the new Golden Age of tech, who are these entrepreneurs? Well, they are increasingly female - with 25% more female billionaires on the Forbes 2014 list than on last year's list. A great example is Elizabeth Holmes, who is 30 and worth $4.5 billion at the helm of her startup, Theranos, which is shaking up the blood-testing industry (Forbes article) - not exactly an Internet or mobile startup at all but leveraging the ingredients I cited above nonetheless. And, with no knock on my Part One of this series, the aspiring tech entrepreneurs are increasingly younger. As this article on Generation Z points out:

[Generation Z is] more entrepreneurial than millennials. 72% of high school students want to start a business someday and 61% would rather be an entrepreneur than an employee when they graduate college, according to a study by Millennial Branding, a consulting firm, and Internships.com.

And, as I pointed out above, the global youth is increasingly more entrepreneurial - both out of necessity as well as benefiting from all of those that came before them. A good book to ground you on this is my friend, Christopher Schroeder's, Startup Rising: The Entrepreneurial Revolution Remaking the Middle East. As we have learned to look to our youth to see what our future will be, I find more aspiring young entrepreneurs as an incredibly promising outlook for the future of tech entrepreneurship overall.

In short, there has never been a better time to launch a tech venture - regardless of your age. The way we are all networked together with mobile supercomputers in our pockets and always online makes the opportunity identification and capitalization faster and cheaper than at any other point in history. The way we are all sharing and learning from each other about how to be entrepreneurs is at an all time high. There are no excuses - this should be your time. Are all of the great ideas taken? No. Are you too old? No - and remember you can always surround yourself with Millennials and Generation Z'ers, like my VC friend Jeremy Liew did when he discovered Snapchat. Is the capital available? Yes, more so than ever. But how do I learn? Blogs, incubators, accelerators, VCs, angel investors, books, mentors. You have never had access like you do now. On the mentor/networking front alone, LinkedIn makes it almost embarrassingly easy - and they have a $19 billion valuation to prove it (yet another thing in common with WhatsApp and Uber, huh?).

I would love to hear your thoughts below. Like always, I will respond to every comment and I hope we get a good thread going on this. Remember that the .io part of Lucky7 stands for input and output.

Update written July 14: A few other reading sources that relate to this:

The Smartest Man in Europe Sees a New Industrial Revolution by Byron Wien, a long-time investor. The whole read is great and I agree with most of it. Specifically, this excerpt relates to this Lucky7 post:

“There is a new industrial revolution taking place around the world based on innovation. It is centered in California but there are pockets of it elsewhere in the United States and in a few places abroad. There are creative new companies being formed every day. Investors underestimate the significance of this change. It is not only in Internet-based technology, but also in biotechnology. Over the next few years you will see blockbuster products being approved for cancer and heart disease. Alzheimer’s and Parkinson’s are proving harder to deal with. In information technology the primary beneficiaries will be Google, Apple, Facebook, Salesforce.com, Microsoft, Amazon, LinkedIn and a few others, but not Twitter, which I view as a company feeding off the primary companies driving the change. These new companies are making IBM a corporate leader of the past. The drivers are changing the way manufacturing is being done, inventories and transportation are being handled and all forms of communication are taking place. The earnings for these companies are open-ended. In biotechnology the new products will extend life and reduce invasive surgery, and who can say how much that is worth? This is all very exciting and should be the focus of every investor’s attention. You can invest in an industrial or consumer company where the earnings are growing 5%–10% annually, but these companies based on technological breakthroughs should do much better than that, and their valuations are still reasonable, in my opinion.”

Six reasons to be excited by the future of venture capital by entrepreneur and investor Mark Suster.

- An excellent analysis on Uber's valuation potential by Bill Gurley of Benchmark Capital, who received his MBA here in UT Austin and backed uShip, one of our best startups here. [Note: I would be a fool to suggest that all of the incredible valuations in the charts above are justifiable over the long term - of course no one knows and only time and execution will tell. The more fascinating thing to me is how quickly markets can be disrupted in this new Golden Age and therefore how efficiently capitalism can work. Uber. Is. Just. Five. Years. Old!]