Today is my 43rd birthday. As I think about the last year, my good friend and CEO coach, Kirk Dando, comes to mind. On page 141 of his excellent book Predictive Leadership, Kirk writes:

Why big life transitions are so hard and why it is so worth it to keep at it

Life is like a record album, composed of songs to form the whole. From age 24 to 40, I had been playing the song "entrepreneur". I set a goal when I was 25 to one day found a tech company and take it public - by the time I was 40. Fifteen years later, I achieved that goal (my ultimate BHAG - "Big Hairy Audacious Goal"). Society didn't know about this very personal BHAG (only a few friends, my parents, and my wife did), and they expected me to keep playing the same song over and over again. This was natural, expected even. But as I wrote about in my "time is money or is money time" post, I was determined to step back and think deeply about my next move post being the CEO of Bazaarvoice. I didn't want to just set the same goal all over again (i.e., "now I'll found a sixth company and take it public again"). I knew I wanted to help entrepreneurs - I had always enjoyed doing so while I was at Bazaarvoice or Coremetrics but I had done so very sparingly due to the time constraints that I had (managing high-growth ventures takes a lot of time). I had love in my heart for Austin and thought I should do my part, along with many others like Josh Baer of Capital Factory, to help our scene evolve. So I jumped into that part of the arena - but in a more "grandfatherly" role as opposed to being the actual "man in the arena" (a nod to Theodore Roosevelt's powerful speech in 1910). As far as becoming an entrepreneur again and going back to that song, I had to think very deeply about it.

What I love about angel investing

Today is my 43rd birthday (you can read about what I learned over the past year inmy Lucky7 post about age 42). Looking back on my last year, I've grown to really love angel investing. My wife, Debra, and I run a family office that we call Hurt Family Investments. She takes the lead on philanthropic projects, and I take the lead on startup investing. For the past two years, we've invested the same financial amount in non-profits as we have in startups. We always agree on what to invest in - she has to meet the entrepreneurs before we make a decision - and that leverages the best of both of us. Debra is a contrarian thinker and was also born to entrepreneur parents. We both learned a lot about entrepreneurship growing up, and we actually started Coremetrics, my fourth business, together. She has terrific entrepreneurial instincts and there are a number of companies that I haven't started because I listened to her (thankfully), when I was playing the song "entrepreneur" on my record of life. Now, we are involved in 34 startups (mostly in Austin) and multiple VC funds that give us exposure to at least as many additional startups (you can see our portfolio here).

What I learned from my top three Lucky7 posts in 2013 … and my biggest busts

December 5th marked my first year of blogging personally (I had previously been a corporate blogger for 7 years at Bazaarvoice). I began blogging primarily as a service to entrepreneurs - a form of giving back to the community that I believe is the greatest force for change. I named my blog Lucky7 as a tribute to my amazing mother, who passed away last year. My first Lucky7 post on December 5, 2012 was a revisit of my manifesto to Bootstrap Austin on March 15, 2005. Looking back, it was clear I deeply cared about the development of our entrepreneurial community in Austin. That caring - and passion - drove a year of many highs in 2013. I've been actively investing in startups since December of last year with my wife, Debra, and I formally chose this as a career a few months ago, forming Hurt Family Investments. We've made 14 startup investments so far, 9 of them Software-as-a-Service (SaaS) companies. I've also joined the Advisory Board of 6 additional companies, all of them SaaS. Out of the 20 startups we are involved in, 16 are headquartered in Austin.

Listening to your soul

Last week was one of the toughest I’ve had. But the struggle was worth it. In Viktor Frankl’s book, Man’s Search for Meaning, he outlines how one’s search for meaning – when conducted authentically – is very hard.

I’m writing to tell you that I’ve decided not to continue to pursue Hurt+Harbach. Please let me be very clear up front on several things:

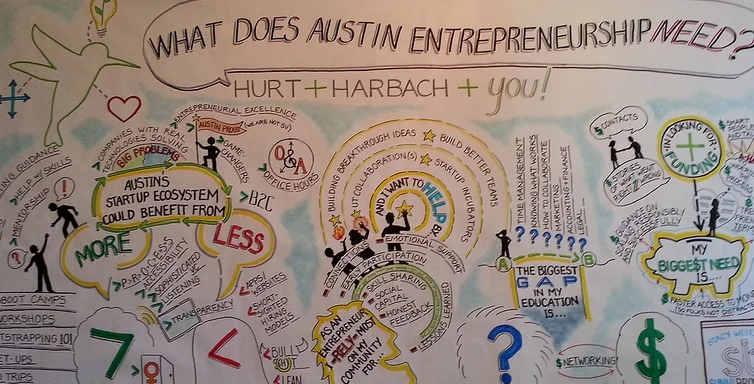

What Hurt+Harbach learned at Lola Savannah, and our next three events

August 27th is a day that Jeff and I will never forget. We spent the evening with many of Austin's best entrepreneurs at the perfect communual venue - Lola Savannah. Together, we began mapping out the future of Hurt+Harbach, and the Austin entrepreneurial scene. We intended to keep the event small - at around 50 people - but hummingbirds can't be stopped and around 125 showed with just a few days notice. All throughout Lola Savannah, boards were displayed with provocative questions and answers were gathered via post-it notes. The awesome Stacy Weitzner, Creative Director of Sunni Brown, Ink, created a mural in real-time in the back to visually represent and memorialize it. It was a happening scene, and it was both humbling and energizing to be a part of it all. The beginning of something really great.

Announcing Hurt+Harbach

I'm very proud to announce Hurt+Harbach, a seed-stage venture capital firm focused primarily on Austin investments.

I've enjoyed working at Austin Ventures since November of last year. I've had a long partnership with the good people there, dating back to August of 2005, when the firm invested in our Series A at Bazaarvoice and Chris Pacitti joined our Board of Directors. My last day at Austin Ventures was August 15.

I'm an entrepreneur, after all. I discovered that I really enjoy being a VC. Helping entrepreneurs is the next phase of my career, and this is a natural evolution for me. Co-founding a new venture capital firm is the ideal way to express my passion for building extraordinary companies.