I had dinner with my good friend and Bazaarvoice co-founder, Brant Barton, on Tuesday at the new Sway in West Lake Hills (yummy) and we talked about lessons learned in angel investing. It was on my mind as I’m doing an AMA (Ask Me Anything) webinar with my good friend and often investing colleague, Josh Baer, on Tuesday, Feb. 5 from 4-5pm CT (you can sign up here). During my conversation with Brant, I distilled down to seven lessons learned (in the spirit of Lucky7, of course). Brant is reading Jason Calacanis’s book on angel investing and told me that many of these are in there (maybe all of these, I haven’t read the book), so you may want to turn to that to really dig in as I’m going to do my best to keep this post short. My hope in sharing these with you is that it ignites more angel investing in Austin - it is vital to our startup ecosystem here. We are doing better on that front in Austin than ever before, but I believe we are only scratching the surface here. And I hope these lessons have an impact beyond Austin angels and startups as well.

Was 42 the answer to my life, universe, and everything?

Today is my 43rd birthday. As I think about the last year, my good friend and CEO coach, Kirk Dando, comes to mind. On page 141 of his excellent book Predictive Leadership, Kirk writes:

Why big life transitions are so hard and why it is so worth it to keep at it

Life is like a record album, composed of songs to form the whole. From age 24 to 40, I had been playing the song "entrepreneur". I set a goal when I was 25 to one day found a tech company and take it public - by the time I was 40. Fifteen years later, I achieved that goal (my ultimate BHAG - "Big Hairy Audacious Goal"). Society didn't know about this very personal BHAG (only a few friends, my parents, and my wife did), and they expected me to keep playing the same song over and over again. This was natural, expected even. But as I wrote about in my "time is money or is money time" post, I was determined to step back and think deeply about my next move post being the CEO of Bazaarvoice. I didn't want to just set the same goal all over again (i.e., "now I'll found a sixth company and take it public again"). I knew I wanted to help entrepreneurs - I had always enjoyed doing so while I was at Bazaarvoice or Coremetrics but I had done so very sparingly due to the time constraints that I had (managing high-growth ventures takes a lot of time). I had love in my heart for Austin and thought I should do my part, along with many others like Josh Baer of Capital Factory, to help our scene evolve. So I jumped into that part of the arena - but in a more "grandfatherly" role as opposed to being the actual "man in the arena" (a nod to Theodore Roosevelt's powerful speech in 1910). As far as becoming an entrepreneur again and going back to that song, I had to think very deeply about it.

What I love about angel investing

Today is my 43rd birthday (you can read about what I learned over the past year inmy Lucky7 post about age 42). Looking back on my last year, I've grown to really love angel investing. My wife, Debra, and I run a family office that we call Hurt Family Investments. She takes the lead on philanthropic projects, and I take the lead on startup investing. For the past two years, we've invested the same financial amount in non-profits as we have in startups. We always agree on what to invest in - she has to meet the entrepreneurs before we make a decision - and that leverages the best of both of us. Debra is a contrarian thinker and was also born to entrepreneur parents. We both learned a lot about entrepreneurship growing up, and we actually started Coremetrics, my fourth business, together. She has terrific entrepreneurial instincts and there are a number of companies that I haven't started because I listened to her (thankfully), when I was playing the song "entrepreneur" on my record of life. Now, we are involved in 34 startups (mostly in Austin) and multiple VC funds that give us exposure to at least as many additional startups (you can see our portfolio here).

Why B2C is so hard to get funded in Austin

My good friend and the founder of Capital Factory, Josh Baer, wrote a post last year saying that he will invest in your B2C startup. Well, so will we. We wrote the first check for ROIKOI, which went on to raise well over $1 million, and also made investments in Bigwig Games, Blue Avocado, Deep Eddy Vodka, Dropoff, and Threadover the past two years. We were also one of the first checks for Wisecrack, but that is based in Los Angeles, and invested in the Series A for talklocal, based in DC. And we are investors in several venture capital funds, including Lead Edge Capital, which holds early positions in Alibaba Group, BlaBlaCar, and other large-outcome B2C companies but these are not in Austin so I guess I'm diverging from my point of this post. In any case, that is a total of eight B2C company investments (if you include Wisecrack and talklocal) out of a total of 33 startups we are involved with, representing 24% of our portfolio (and 18% if you exclude Wisecrack and talklocal).Real Massive also has a kind of B2C dynamic, even though it is B2B, so maybe I should count them too as they are Austin-based. But our primary focus is SaaS, for which we have holdings in 19 startups (57% of our portfolio). Both Bazaarvoice and Coremetrics were/are SaaS businesses and we have the most experience to bring to that category. SaaS is also far less risky than B2C, and that brings me to the real point of this post.

'Is it too late for me to start my own business?', and other sheepish questions (part 1 of 3)

This is part one of a three-part series on entrepreneurship. The parts:

- 'Is it too late for me to start my own business?', and other sheepish questions

- Who this new generation of aspiring entrepreneurs are and the new Golden Age of tech (Lucky7 post)

- How I define the soul of entrepreneurs: you change the world (Lucky7 post)

Part One

It's March of 2013 and I'm at Wharton serving as an Entrepreneur-in-Residence when I get a question that baffles me. I'm speaking at the Penn Founders' Club, where all University of Pennsylvania students are welcome as long as they are fervently working on a real business while they are in school. I've just wrapped up my opening comments and it is time for Q&A. The baffling question: "Have all of the really big ideas already been thought of?". I couldn't believe it when I could see the student was being serious and not just pulling my leg, and I was fired up. I passionately describe how the world always needs entrepreneurs to drive it forward, and there are always ideas - everywhere - if you just look hard to find them. I talk about how I just read the book Abundance, wrote the longest book review of my life on it at Lucky7, and there are thousands of great ideas in the book for entrepreneurs to solve the world's biggest problems. A few months later, Waze gets bought for $966 million by Google. A few months after that, Snapchat gets a rumored $3 billion offer from Facebook, which I wrote about in this Lucky7 post on valuations. And then almost a year after receiving that question at Penn, WhatsApp gets a firm acquisition offer of $19 billion from Facebook, one month after Google buys Nest for $3.2 billion.

Who this new generation of aspiring entrepreneurs are and the new Golden Age of tech (part 2 of 3)

We live in very interesting times. It's 2010 and I'm at a family reunion. We've just barely survived the most cataclysmic global financial crisis in the modern history and one of my cousins asks me, "How can tech be doing so well while the rest of the economy is doing so poorly?". I did my best to answer but the question kept eating at me. I remembered Michael Porter's Harvard Business Review article about the Internet being the sixth force - and how it would disrupt all of the previous five forces cited in his famous strategic model.

Fast forward just four years later and a five-year old company, WhatsApp, is bought for $19 billion by Facebook, a company that itself is only ten-years old at the time but worth a mighty $170 billion. Just two years earlier, when Facebook went public, the media was asking for Morgan Stanley's head - and sometimes Mark Zuckerberg's or David Ebersman's (CFO of Facebook) head - for what was perceived at that time as an overpriced IPO. Except that it wasn't... and any investors that held on to their IPO stock should now be very happy campers.

Learnings from three entrepreneurs and one VC I interviewed this past semester

I joined the McCombs Business School at the University of Texas at Austin as Entrepreneur-in-Residence this past semester. I kicked it off with a speech to the entering MBA class about the top-ten lessons I wished someone had taught me when I was beginning my MBA. I have very much enjoyed my first semester in this capacity and the entrepreneurial energy on campus is really fantastic. There is no doubt a huge trend towards entrepreneurship at most top-ranked universities and U.T. Austin is leading the way in one of the most entrepreneurial cities and states in our nation. Consider that Texas has created 70% of the new jobs in the U.S. since 2005, as reported by BBVA Compass, and you start to tune in a bit more into what is happening here. Compared to when I attended U.T. Austin from 1990-1994, where entrepreneurship was hard to find, every major college at U.T. now has its own entrepreneurial club and initiatives. In my Office Hours, I have met with over a hundred students who have either launched their own business while at the University or they are actively planning on doing that at some early point in their career (I didn't become an entrepreneur myself until I was 24 and beginning my MBA, so I tell them I was a "late bloomer").

Listening to your soul

Last week was one of the toughest I’ve had. But the struggle was worth it. In Viktor Frankl’s book, Man’s Search for Meaning, he outlines how one’s search for meaning – when conducted authentically – is very hard.

I’m writing to tell you that I’ve decided not to continue to pursue Hurt+Harbach. Please let me be very clear up front on several things:

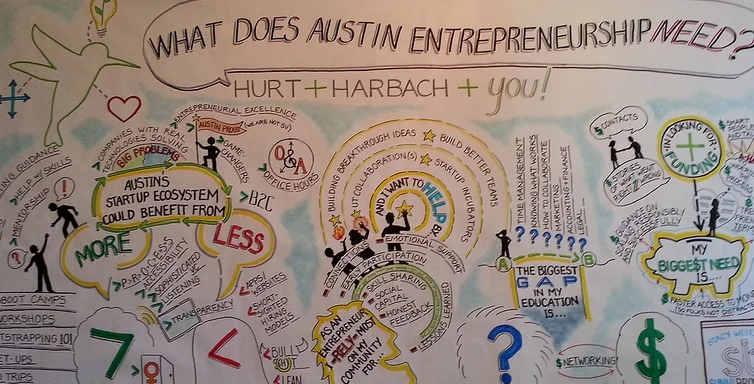

What Hurt+Harbach learned at Lola Savannah, and our next three events

August 27th is a day that Jeff and I will never forget. We spent the evening with many of Austin's best entrepreneurs at the perfect communual venue - Lola Savannah. Together, we began mapping out the future of Hurt+Harbach, and the Austin entrepreneurial scene. We intended to keep the event small - at around 50 people - but hummingbirds can't be stopped and around 125 showed with just a few days notice. All throughout Lola Savannah, boards were displayed with provocative questions and answers were gathered via post-it notes. The awesome Stacy Weitzner, Creative Director of Sunni Brown, Ink, created a mural in real-time in the back to visually represent and memorialize it. It was a happening scene, and it was both humbling and energizing to be a part of it all. The beginning of something really great.